12 Must Have Strategies for Every CEO

I work with many CEOs and Business Owners every day and one of the important questions is “How do I maximize the value of my company”?

If you are leading an earlier stage private company, you want to maximize the company value for the fund raising rounds.

Achieve predictable revenue growth of 25% or more in your B2B business this year

Get my detailed infographic to see how you can follow my unique framework to scale your business, step-by-step. Click below to download the Ultimate Revenue Acceleration Guide.

If you are leading a later stage private company, you want to maximize the company value for the IPO.

If are leading any stage company, you want to maximize your value to potential acquirers for M&A.

Often, these are the desired outcomes, but the foundation has not been laid to make this possible. What you need is an intentional strategy to build and unlock the value in your company and an intentional strategy to maximize the value of your company before fund raising, M&A or an IPO.

I have been fortunate as a CEO for private and public companies to prepare the way for these outcomes. One of my Venture Partners always had a saying that “it is better to be bought than sold”. I totally agree.

When I was the CEO at Intacct, a leading SaaS financial applications solutions provider, headquartered in Silicon Valley, I implemented many of the steps below; When you intentionally build value and orchestrate these potential steps for acquisition, good things happen. The Company was acquired by The Sage Group for $850 million or 9 times the revenue run rate.

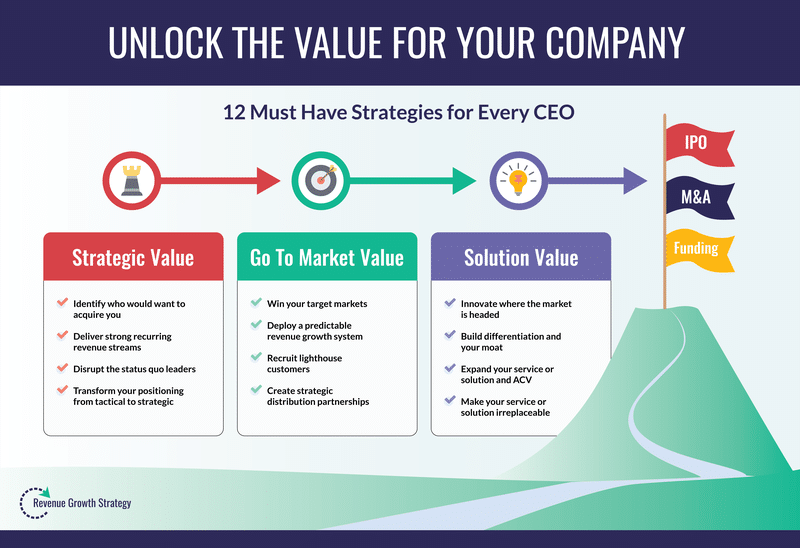

Today, I work with CEOs and Founders to create this intentional strategy and implement the steps that will bear fruit over the next 3-5 years. There are 12 strategies to create and unlock the value in your company that will serve you when it is time to raise money, be acquired or plan for an IPO. They are categorized below as strategic value, go-to-market (GTM) value and solution value. Let’s review each of these strategies.

Strategic Value

1. Identify Who Would Want to Acquire You

A great question to ask yourself is “who would acquire your company and why?” One of the tasks every CEO or Founder should spend time on is to put together a list of at least 10 companies that would want to acquire your company. When you start evaluating these companies you may see that you could help them address a gap in their solution or service offering. You may bring expertise and deep domain knowledge in vital areas that they lack. You may also have a strong presence and domain understanding in markets or industries that they find attractive.

When I was the COO at Silicon Energy, we delivered an enterprise energy management software platform to energy providers and large energy consumers in the commercial market. We had an excellent software development team and decided to branch out into several commercial markets beyond the utility industry. One of our strategic partners is a large hardware company focused on serving the utility market. They appreciated our expertise developing software and expansion beyond the core market into energy hungry markets like mining, manufacturing, chemicals, and energy so they acquired Silicon Energy. What we had and what they wanted were truly complimentary.

2. Deliver Strong Recurring Revenue Streams

All companies have the ability to create “sticky” recurring revenue streams. Everything has become or will a subscription. A recurring revenue stream gives any potential acquirer greater visibility and reassurance into the future years for revenue and cash flow.

For one of my clients, I am working with their Customer Success team to create new services bundles for their customers and prospects. They need more enablement services to realize the value of their financial management and coaching for performance solutions.

For another client, they created 15 point solutions for the higher education industry, but their typical customer only used 3 of these point solutions. Through the development of suites for specific areas tied to a specific champion we were able to move up to 8 solutions per customer – a dramatic change in wallet share per customer that pay dividends every year.

3. Disrupt Status Quo Leaders

In any market, it is always a good sign if you can replace the status quo leaders in that market. It proves to your audience that your services or solutions are robust enough to unseat or replace the status quo or legacy leaders. This is especially important to prove if you are selling into a replacement market and there is a question about the size of the addressable market.

At Intacct, many companies were already using a financial accounting solution like QuickBooks so it was important to determine the inflection point and why someone would outgrow their current financial accounting solution.

4. Transform Your positioning from Tactical to Strategic

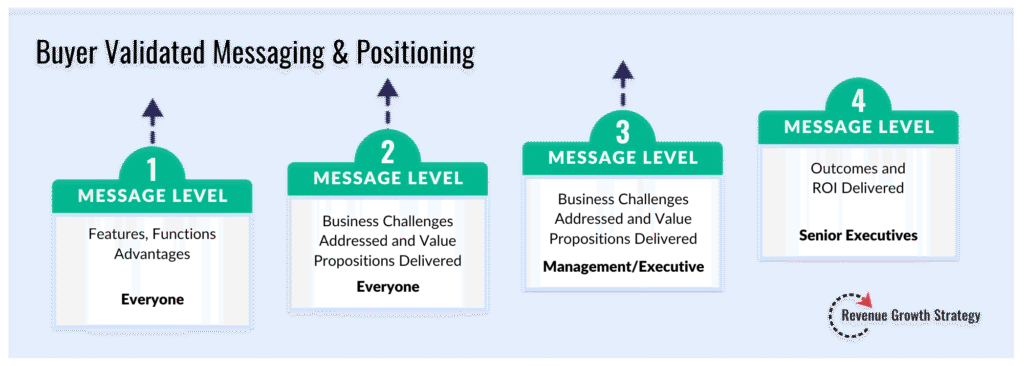

I find it interesting that if you are providing a software solution or service, the immediate call to action is always to get you to a demonstration or presentation. The engagement is typically tactically focused because there is no upfront discovery of business challenges, strategic positioning or engagement with the buyer. There is a stair step way to elevate your value from tactical to strategic.

When you sell and deliver strategically, you solidify the lifetime value (LTV) for your solution or service and you become mission critical for each company. Many companies start presenting their solution or service tactically, but you can elevate your messaging and positioning from that level to level 2 when you focus on the pains/business challenges that you address and the corresponding solution that you provide to address them. You can move from level 2 to level 3 which is about process optimization such as the procure to pay process, lead to close process, source to delivery process and so on; what business process do you help your buyer optimization? Finally, you can move from level 3 to level 4 positioning and messaging when you focus on your target decision maker and the associated value, ROI and outcomes that they will receive with your service or solution.

The solution or service did not change; the way you presented your solution or service did. Investors want to invest in mission critical, ROI-driven, churn resistant solutions and services. Decision makers want to know what value you deliver to them every day. When I was the CEO at Intacct, we focused our value propositions on Level 3, optimizing the financial processes for every company. When we introduced executive dashboard technology, we moved to Level 4 because we delivered the KPI dashboard for the CFO so they could monitor and manage the heartbeat of their company every day.

Go-To-Market (GTM) Value

5. Win Your Target Markets

Many companies sell horizontal solutions that can address the needs of many customers and many markets. Where you have traction, it is always better to deploy a strategy to win a specific market. That market could be an industry such as healthcare, energy or financial services or a geography such as North America or enterprise vs. SMB market.

One of my customers has sold to the same niche market for 12 years. I asked them how many companies were in their target audience, and they did not have the exact number. We discussed the difference between having a “competing strategy” and a “winning strategy”. They have been competing in that niche market to win new customers for 12 years. We helped them determine the exact number of companies in that niche market and then reach every stakeholder at every company. This focused approach helped them penetrate and win 100% of that target market.

When you “win” a target market everyone realizes that it is easier to acquire you get these customers than to try to unseat you.

6. Deploy a Predictable Revenue Growth Engine

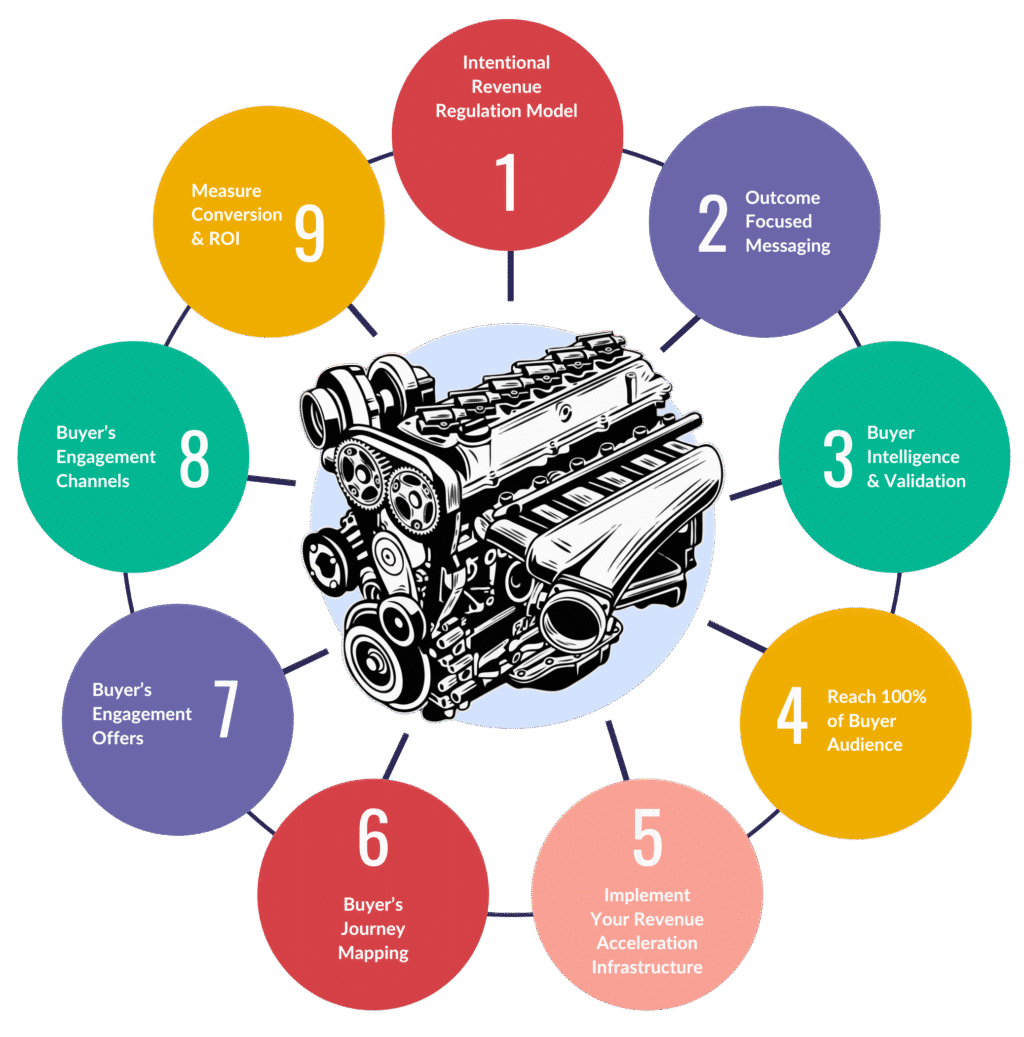

How do you prove to investors, acquirers and partners that your business is sustainable and scalable? You need to create and deploy your “system” that delivers predictable revenue growth. For every public company, the CEO and management team must demonstrate that they made the quarterly revenue and profit goals and provide accurate forward guidance. You can only accomplish this if you have implemented a predictable revenue growth engine.

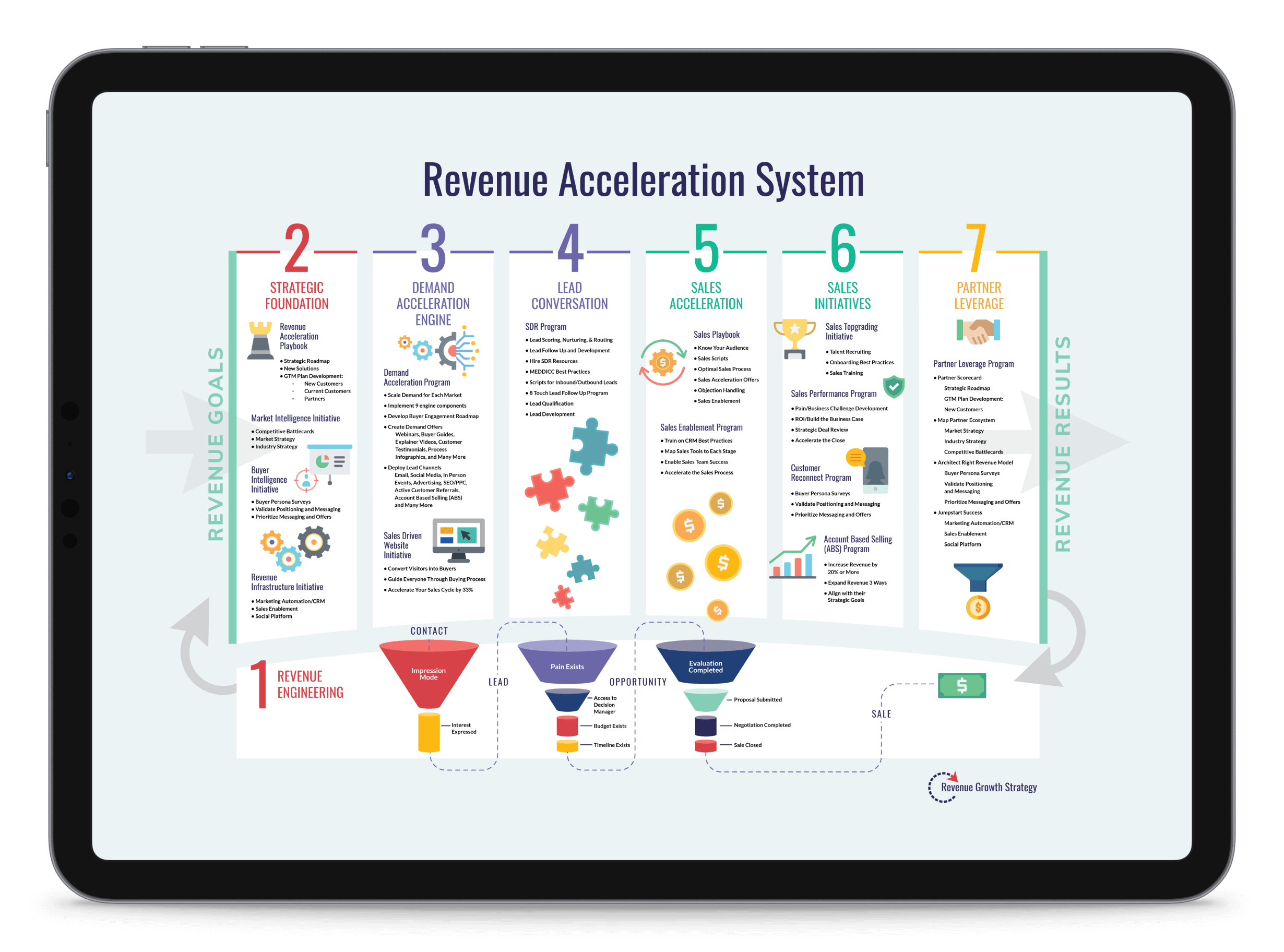

There are nine components that you need to implement in your revenue growth engine. You can create this engine for any target market or segment, your customer base and your partner channel. Investors and acquirers love predictable revenue growth models and outcomes. One of your strategic value drivers is to forecast accurately and exceed that forecast every quarter.

When I was the CEO at Intacct, a fast growing SaaS financial applications provider, I created this engine for many industries and channels. Since then, the engine has been implemented with many successful B2B companies and can be a differentiated value driver for your company as well.

7. Recruit Lighthouse Accounts

In any market there are well recognized, Fortune 5000 companies that would qualify as wonderful Lighthouse accounts. Once a lighthouse account starts to us and benefit from your services or solutions it is much easier to penetrate that specific market. This is as close as you can get to reference or referral selling.

When I was the CRO at RightWorks we provided an eProcurement solution that could be used to manage in-house procurement and also provide an external e-commerce marketplace. One of our first customers was Wells Fargo and they became a great partner and customer. Wells Fargo is the largest provider of small business loans and they recognized the opportunity to pass along their significant discount to their customers through their externally focused e-commerce marketplace. Once they proved out the model, many other banks and financial services institutions also became customers at RightWorks.

8. Create Strategic Distribution Partnerships

There are many types of sell with or sell through channel partnerships that a company can create but the most valuable are embedded or OEM distribution partnerships where your service or solution is private labeled by the partner and embedded in every sale. This type of partnership eliminates the challenge of presenting the contractual relationship between your company and the partner company to prospective buyers. Embedded sales also creates a dependency by your strategic partner on your ongoing services and support.

When I was COO at an enterprise energy management software company, one of our strategic partners, CGEY sold our solution as their own. This completely eliminated any friction in the sales process and leveraged the excellent strategic relationship that CGEY had with its’ enterprise customers.

When I was CEO at Intacct, 50% of our revenue was derived through channel partners. These partners included Accounting/CPA firms, industry market makers, systems integrators and strategic sell with partners like Salesforce.

Solution Value

9. Innovate Where the Market is Headed

Often young, nimble companies can innovate much faster than large, established companies. The key here is to innovate where the market is headed so that potential acquirers want to leverage that innovation.

Intacct was always a SaaS, Cloud native offering. Many of the established financial application solution companies were primarily offered on premise. As the cloud became more popular and accepted, the need and later the imperative to offer a cloud alternative became more compelling. Today everyone offers a cloud version.

Customer expectations and technology are always changing. Many companies cannot innovate and build internally so they must partner or acquire what they need.

10. Build Differentiation, Community and Your Moat

What are the 5 differentiators that make you unique and valuable? For many companies they have not invested the time to think about what makes them truly unique and valuable. A great place to start is to create a strategic messaging roadmap that maps out all of the challenges to address and value/ROI that you deliver as your solution or service addresses these challenges.

You build community when you work with your target decision makers and help recognize their leadership and evangelism for your solution and company. All leaders want to success and when you align with the C-Suite you create a powerful community.

Finally, you need to create a moat around our solution, service and company. Do you “own” your differentiated message? Have you won a target market? Do you have a large group of decision makers and leaders that advocate for you and your company?

11. Expand Your Solution or Service and ACV

How can you grow your annual contract value (ACV)? If you offer a solution or service today, does it meet all of the needs for your buyer? I typically find that it only meets some of your buyers’ needs. There is always an opportunity to expand your solution or service into the “whole solution”

Let me give you an example. When I worked with ICUC, a global social management services company, they offered individual social management services to F5000 companies. They are an innovative services company, and we helped them launch new services every year; it quickly became obvious that their sales team had a hard time presenting and selling all of these individual services. So, we created the social customer journey so that every customer or prospective buyer could understand which services were utilized in each phase of the social customer journey. Also, most customers now understood that they needed all of these connected services to address the full social customer journey. This strategic positioning helped ICUC to significantly increase the size of their ACV.

12. Make Your Service or Solution Irreplaceable

Finally, you need to make your service or solution irreplaceable; to make something irreplaceable is to ensure that your target audience cannot operate without your solution or service. Many offerings today are in the “nice to have category” and need to be transformed into the “must have category”.

Salesforce offers an excellent example of this transformation. Initially they provided CRM applications and differentiated their solution as a simple, easy to use sales tool in the cloud. Their solution was just right for that time and they disrupted the status quo leaders. However, the challenge with CRM solutions is that they experience substantial churn, some as high as 20% year-over-year and there are over 5000 CRM software companies making for a crowded market.

To make Salesforce irreplaceable, they created Force.com – a complete software development platform so that companies could build their operational and mission critical systems. Once these systems were built and put into operation, it was 10 times more difficult to replace them, unlike the CRM market. Same company – but different outcomes with each strategy.

Prepare for Due Diligence

Last, is always important to prepare for a potential acquisition. When an acquirer knocks on your door they will want to audit your financials, customer and partner contracts, intellectual property and patents, etc. Keep everything organized so that it is easily accessible to prove your value.

Another good practice is to negotiate strategic partnerships so that it is easy to ascertain the economic value of any partnership. Are there minimum levels of performance required? Is the economic exchange easy to quantify? When a contract or statement of work is undertaken is there written proof or agreement that all work has been performed. This eliminates any concern about litigation or exposure later in time for the acquirer.

About the Author

Robert Jurkowski is the CEO and founder for Revenue Growth Strategy, a revenue growth advisory firm that partners with CEOs and Founders to help them create and implement their strategy and revenue growth plan that is capital efficient, leverages best practices and delivers results.

He has built many successful software and services companies as CEO, COO and Chief Revenue Officer in Silicon Valley and understands what is needed to succeed as an operating executive and strategic leader.

To discuss how you can leverage these 12 strategies to maximize your Company’s value prior to fund raising, M&A or an IPO you can reach Robert at robert@revenuegrowthstrategy.com or call him at 1-800-735-6520.